What Does Square Credit Card Processing Do?

Wiki Article

Online Payment Solutions Fundamentals Explained

Table of Contents3 Easy Facts About Virtual Terminal ExplainedOnline Payment Solutions Things To Know Before You Get ThisPayeezy Gateway Fundamentals ExplainedAn Unbiased View of Comdata Payment SolutionsExcitement About Payeezy GatewayFirst Data Merchant Services Things To Know Before You Get ThisThe Greatest Guide To Credit Card Processing CompaniesGet This Report about Square Credit Card ProcessingCredit Card Processing - Questions

One of the most usual grievance for a chargeback is that the cardholder can not keep in mind the purchase. Nevertheless, the chargeback proportion is extremely low for transactions in an in person (POS) atmosphere. See Chargeback Monitoring.You do not need to come to be an expert, yet you'll be a much better customer if you recognize just how debt card handling really works. To comprehend just how the repayment process works, we'll consider the stars and their roles. Who are the stars in a credit score and also debit card deals? obtains a debt or debit card from an uses the account to spend for goods or solutions.

The 45-Second Trick For Virtual Terminal

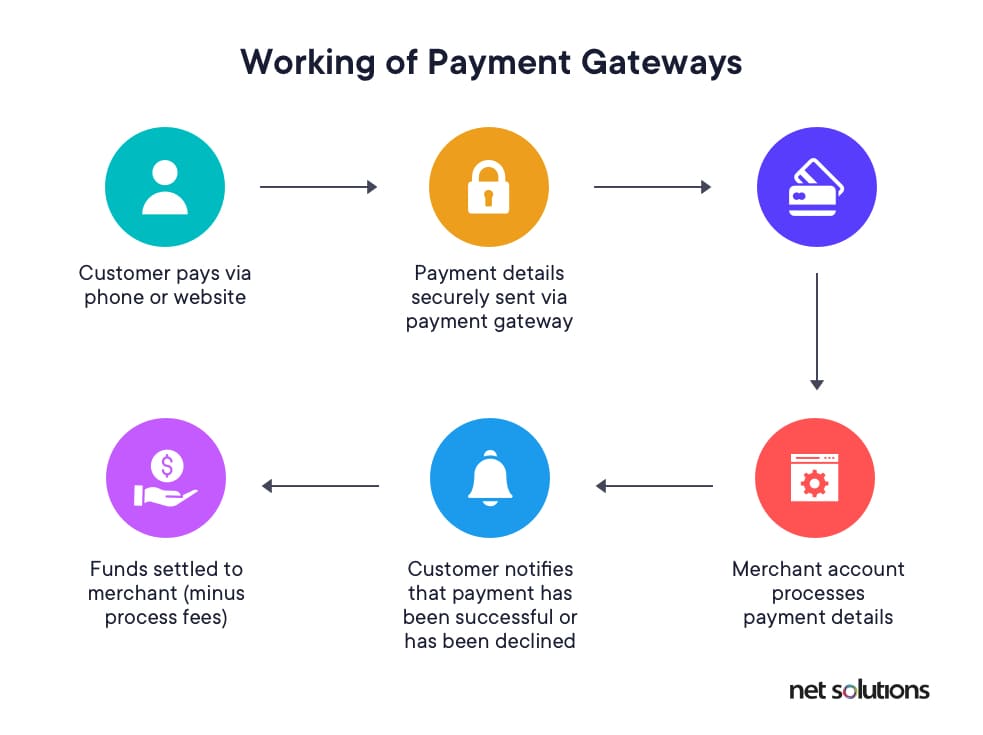

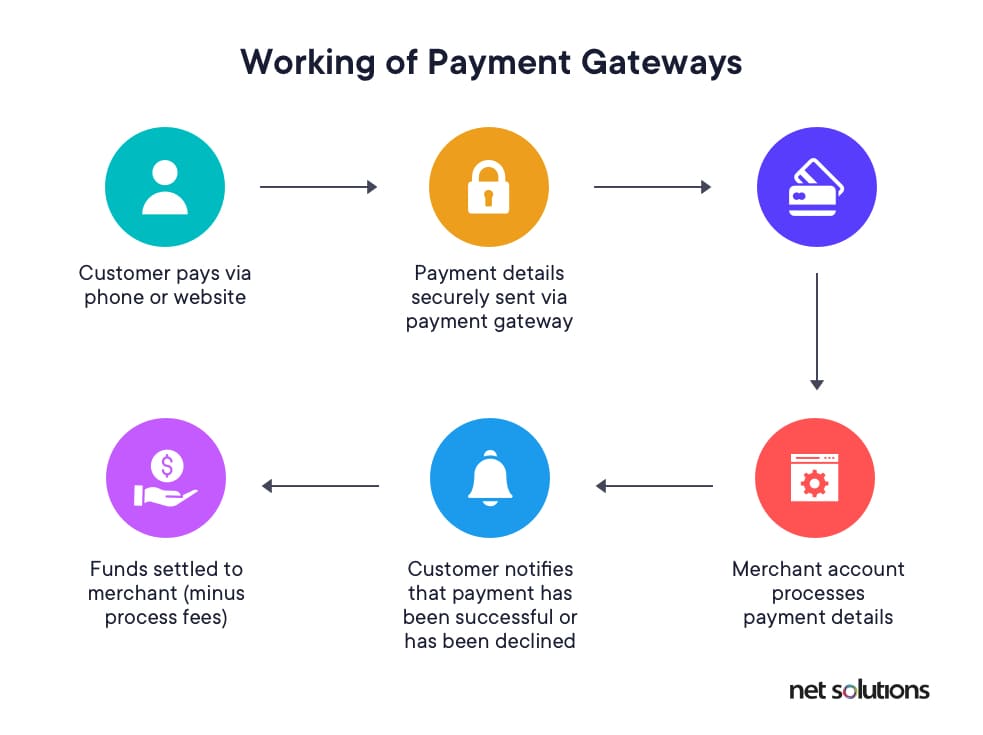

That's the credit card process essentially. Now let's look at. send sets of authorized deals to their. The passes transaction information to the that connect the suitable debits with the in their network. The costs the account for the quantity of the transactions. The after that transfers suitable funds for the transactions to the, minus interchange fees.

See This Report about Square Credit Card Processing

You can get a merchant account by means of a repayment processing business, an independent service provider, or a large financial institution. A repayment processing company or financial establishment handles the purchases between your customers' financial institutions and your bank.You must permit vendors to accessibility info from the backend so they can view history of repayments, terminations, as well as various other deal data. PCI Safety and security aids suppliers, sellers, as well as financial organizations execute criteria for producing protected repayment solutions.

Online Payment Solutions for Dummies

Pay, Pal, for circumstances, is not subject to banking policies, so it can freeze your account as well as consequently your cash at will (first data merchant services). Various other downsides consist of high prices for some sorts of settlement processing, restrictions on the number of purchases daily as well as amount per deal, and safety and security holes. There's additionally a variety of on-line repayment handling software (i.

Fascination About Credit Card Processing Companies

vendor accounts, often with a settlement entrance). These platforms vary in their payments as well as assimilation possibilities some software application is much better for audit while some fits fleet more tips here monitoring best. An additional option is an open source repayment handling system. Yet do not believe of this as totally free handling. An open resource platform still needs to be PCI-compliant (which costs around $20k annually); you'll need to release it and preserve numerous nodes; and also you'll require to establish a connection with an acquiring financial institution or a payment cpu.Some Known Questions About Virtual Terminal.

They can additionally make your cash money flow extra foreseeable, which is something that every local business proprietor makes every effort for. Discover out more exactly how about B2B repayments work, and also which are the very best B2B repayment products for your small company. B2B repayments are payments made between two merchants for products or solutions.

Clover Go for Dummies

People entailed: There are multiple individuals included with each B2B purchase, including balance dues, accounts payable, billing, and purchase teams. Repayment delay: When you pay a buddy or family participant for Click This Link something, it's often right on-site (e. g. at the dining establishment if you're dividing an expense) or simply a few hours after the event.Because of the intricacy of B2B settlements, a growing number of services are going with trackable, digital settlement alternatives. Fifty-one percent of organizations still pay by check, declining from 81% in 2004. As well as 44% of services still obtain settlement by check, declining from 75% in 2004. There are five primary means to send as well as obtain B2B settlements: Checks This group consists of traditional paper checks and electronic checks provided by a purchaser to a vendor.

The Basic Principles Of Virtual Terminal

Cable transfers These are funds transfers in between banks that are directed through a financial network like SWIFT. Wire transfers normally provide money within hrs. Electronic financial institution transfers These are settlements in between financial institutions that are transmitted via the Automated Clearing Up House (ACH). This is just one of the best and trustworthy payment systems, yet bank transfers take a couple of days much longer than virtual payment wire transfers.Each choice varies in convenience of use for the sender as well as recipient, expense, and also security. That claimed, most services are moving away from paper checks as well as relocating towards digital and also electronic settlements.

Rumored Buzz on Ebpp

Settlements software application and applications have reports that give you an introduction of your accounts receivable and also accounts payable. As an example, if there a few merchants that routinely pay you late, you can either enforce more stringent target dates or quit working with them. B2B repayment services also make it less complicated for your clients to pay you, aiding you get payment much faster.Report this wiki page